What is FOREX?Basic knowledge about Forex!For those who start Forex from now on

Welcome to “ZENSHIRABE”

Here, when you start Forex, i have a basic knowledge about Forex of the contents that You have found and learned.I hope it will be information that will be useful information even a little “good to examine”.

What is FOREX?I will explain “basic knowledge about Forex” in an easy-to-understand manner to those who start Forex from now on, such as what it is, how much money is needed to start and how much forex trading mechanism is needed, why profit comes out!

What is FOREX?-About FX

Forex refers to “Foreign Exchange” in English, which is abbreviated as “Forex” (Forex), which is abbreviated further.

Forex means “foreign exchange trading”, but recently it has become a common term to refer to “foreign exchange margin trading”.

What is traded in Forex is the exchange of money and money.The exchange rate is constantly changing due to the trend of people who want to buy or sell currencies around the world.In Forex, you can use this exchange rate fluctuation to gain profit.

Two transactions came out, “Foreign Exchange Trading” and “Foreign Exchange Margin Trading”, but if you raise the difference easily, it will be a point of whether to trade forex trading with “margin”.First of all, I will explain what “foreign exchange trading” is.

Forex, I’m not sure, but it’s about “foreign exchange margin trading”.

In a word, it is “a transaction that aims at the profit by buying and selling between currencies”.

What is FOREX?- What is forex trading?

I will explain briefly what foreign exchange trading is.

For example, if you are going on a trip abroad, you must first convert the yen into the currency of the country you are traveling to.In the United States, it is dollars, so I exchange yen into dollars at a Japanese bank.The act of currency exchange of yen and dollar is called foreign exchange trading.

Buy foreign currency at low prices and sell it when it gets higher, and the difference is profitable.This is the basic way to profit from forex trading.Let’s give an example of what it means.

First of all, before going on a trip from Japan to the United States, let’s exchange yen into dollars.

- The exchange rate is assumed to be “one dollar to 100 yen”.

- The amount required for the destination is 10,000 dollars.

Required dollar x rate: Yen 10,000 y

en x 100 yen required for exchange of money

You’ll need one million yen to convert to 10,000 dollars.Therefore, if you have one million yen, you can exchange it for 10,000 dollars.

If it’s an exchange rate of 100 yen per dollar, you’ll need one million yen to convert it to 10,000 dollars.

Right!So, if you have a million yen, you can convert it into 10,000 dollars.

Next, when you come back to Japan from the United States, let’s exchange dollars into yen.

- It is assumed that the exchange rate is “one dollar to 110 yen”.

- The remaining amount from the destination shall be 10,000 dollars.

Remaining amount x rate, amount after ex

change of money 10,000 usd x 110 x 1.1 million yen

If the exchange rate goes from “one dollar to 100 yen” to “one dollar to 110 yen”, you will get 100,000 yen.On the other hand, if you get to “one dollar to 90 yen”, you can see that you will lose 100,000 yen.

Just because the exchange rate is different, it can be profitable and profitable.

That’s why you get a profit by buying it when it’s cheap and selling it at a high price.

What is FOREX?-What is foreign exchange margin trading?

FX (Foreign Exchange Margin Trading) is a transaction in which foreign exchange trading described above is carried out with “margin”.

“Margin” is like “collateral” that you deposit with a Forex company when you make a transaction.

Forex will be trading using the settlement method called “cash settlement” that was promised to settle (opposite trading).Therefore, it is not necessary to deliver cash of the total transaction amount, and the transaction is completed only by the delivery of the profit and loss of the sale.

For example, if USD/JPY (USD/JPY) is trading at 10,000 dollars when it is 100 yen per dollar, you cannot get 10,000 dollars if you do not have 10,000 dollars x 100 yen .

However, forex is a “margin transaction” that adopts margin settlement, so if you are a Japanese domestic Forex trader, you can trade for 1 million yen , 10,000 dollars, just deposit the margin of 4 percent of 1 million yen (40,000 yen).

Transaction amount x transaction rate,

total transaction amount 10,000 usd x 100 yen , 1,000,000 yen

Total transaction amount x minimum margin ra

tio required: Required minimum margin 1,000,000 yen x 4%

If a loss of 100,000 yen occurs, it will be deducted from the margin you are depositing, and if you get a profit of 100,000 yen, it will be added to the margin you are depositing.

Forex that can trade with margin, funds efficiency by trading leverage, you can large trading with a small amount of funds.”Leverage 25 times” refers to “25 times the total transaction value is 25 times relative to margin”.

Leverage trading is amazing, isn’t it?

Leverage is the principle of “teko” and you can make big transactions with a small amount of money.

What is FOREX?-How much money do you need to start Forex?

To start Forex, I will explain how much money is actually required.

In Forex, trading units are called “currency” or “lot”.In the case of domestic Forex in Japan, 10,000 currencies become basic trading units, and “10,000 currencies are 1 lot”, but in overseas Forex, it is basically “100,000 currencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

For example, if USD/JPY (USD/JPY) is 1 dollar to 100 yen, you will need “10,000 currencies : 10,000 US dollars – 1,000,000 yen” because it is “10,000 currencies .

The minimum trading currency is different depending on the Forex trader, but there is also a trader who can trade from one currency.Therefore, it is also possible to start with a margin of 100 yen or less.

There is a Forex trader that can trade from one currency.

That’s right.However, if it is a currency, it is a small transaction, so the profit is also a small amount.So leverage is an important point!

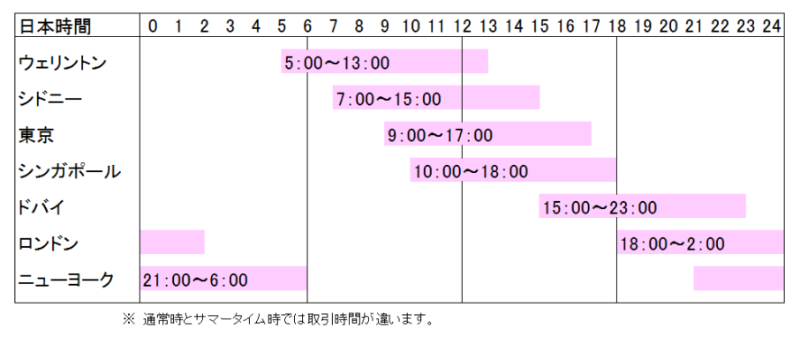

What is FOREX?-About the time zone when Forex can be traded

Forex (Forex Margin Trading) is basically capable of trading 24 hours a day except Saturdays and Sundays.

One of the characteristics of forex trading is that you can trade anytime, anywhere.Because foreign exchange markets exist in major cities around the world, and foreign exchange trading is a “relative transaction” of how to close transactions on the individual “people who want to buy” and “those who want to sell” via the telephone or the Internet, and the whole world forms a single market. As long as the financial institution you want to sell in some country or region is doing business, the transaction will be closed regardless of the time, so you can participate in the transaction at any time.

In that, even in the transaction of the same currency pair at the same time, the closing price is different depending on the individual transaction, so please remember that the exchange rate may vary depending on the trading company.

In summary, foreign exchange is basically always traded on Saturdays, Sundays and days other than January 1, and Forex can also trade 24 hours a day, so it is possible to trade according to the lifestyle of various people who trade Forex.

Please note that we cannot trade during the maintenance window.

There are foreign exchange markets all over the world!

Because you can trade 24 hours a day, for example, even if you are busy with work, you can easily trade in a little interval time, such as travel time and return home time!

What is FOREX?-How does Forex make profits?

If you don’t know how to make a profit even if you trade in Forex, you don’t know how to make a profit even if you start Forex.So, there are three ways to make a profit here, so I’ll explain a little more specifically.

- How to make a profit from buying currency by buying it

- How to make a profit from a sale of currency

- How to make a profit with swap points

There are three.

Let’s take a look at it in order from 1.

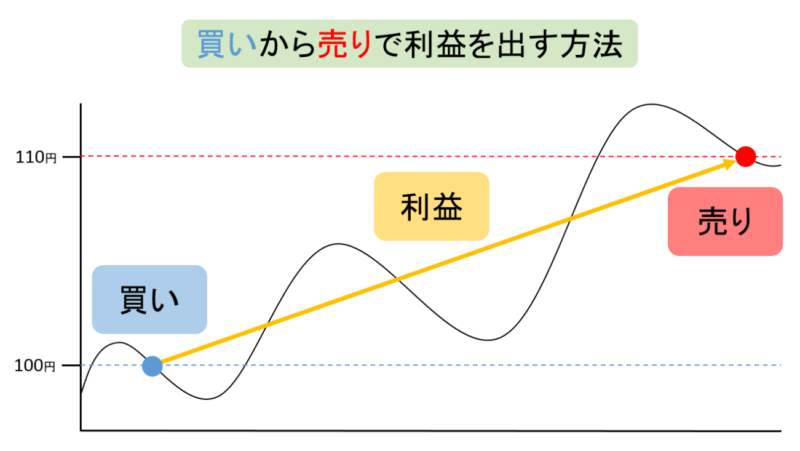

What is FOREX?-1. Foreign exchange gains – How to make a profit by buying currency by buying it

The biggest chance to profit from Forex trading is to trade in a transaction that aims at foreign exchange gains due to price fluctuations.The first “how to make a profit from buying” is “buying cheaply” in the buying and selling of currency to “high selling”.This is the same basics as stock investment and so on.

For example, it is a way to make a profit when “one dollar is 100 yen” and “it is likely to become a weak yen” to “one dollar to 110 yen”.I will explain the following example.

For example, if the exchange rate is “1 million yen” and the exchange rate is “1 dollar to 100 yen”, you want to buy “10,000 dollars”.And, since the exchange rate is “1 dollar to 110 yen”, if you sell “10,000 dollars” and confirm the profit (to settle), it will be the following profit.

(110 yen – 100 yen) x 10,000 dollars – 1.1 million yen

1.1 million yen – 1 million yen – 100,000 yen

The exchange rate of “10 yen” fluctuated, resulting in a profit from the foreign exchange gain of 100,000 yen.

Next, I’ll explain the above transaction using a different word.

For example, if the “margin 1 million yen” and the “USD/JPY” exchange rate is “USD/JPY” exchange rate of “1 dollar to 100 yen”, you buy “10,000 currencies” with “leverage 1 times”.And, since the exchange rate becomes “one dollar to 110 yen”, if you sell (settle) the profit by selling (settlement) of “10,000 currencies”, it will be a profit of 100,000 yen.

As for the meaning, do you understand?I used the word of currency and leverage, but it becomes the content together as the content.

I explained a little in “How much money do I need to start Forex?”, but I will briefly review the currency and leverage.

In the case of the exchange rate of “1 dollar

to 100 yen”, 1 d

ollar, 1 000 dollars per currency, 10,000 c

urrencies 10,000 currencies, margin 1 million ye

n, 11, leverage 1 times

Another example at the above rate is

10,000 currencies / margin 200,000 yen – leverage 5 times

10,000 currencies / margin 10,000 yen – leverage 100 times

10,000 currencies / margin 1,000 yen – leverage 1,000 times

In the case of the exchange rate of “1 dollar

to 120 yen”, 1 do

llar, 1 000 dollars per currency, 10,000 cu

rrencies 10,000 currencies, margin 1.2 million ye

n, 11, leverage 1 times

10,000 currencies / margin 200,000 yen – leverage 6 times

10,000 currencies / margin 10,000 yen – leverage 120 times

10,000 currencies / margin 10,000 yen – leverage 1,200 times

This is “how to make a profit from buying” .In this example, it was a profit of 100,000 yen with a margin of 1 million yen, but I wanted to tell you that by utilizing “leverage” without necessarily requiring a margin of 1 million yen, even a small amount of funds can generate a large profit.However, since there is also a problem of maintenance rate, margin is better to do more in order not to miss a chance.

You just have to buy as much as possible cheaply and sell as much as possible.

Many are good, but if you raise the number of lots too much, you worry about “margin retention rate”!

The loss cut rate is different for each trader, so you have to be careful.

What is FOREX?-2. Foreign exchange gains – How to make a profit by buying back currency from selling

The biggest chance to profit from Forex trading is to trade in a transaction that aims at foreign exchange gains due to price fluctuations.

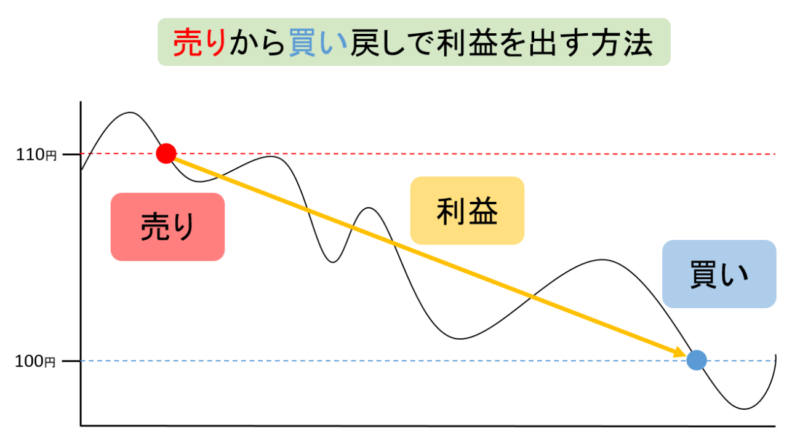

On the other hand, the second “how to make a profit from buying from a sale” is “buying back cheaply” from “high selling” in the buying and selling of currency.This is the same as selling credit transactions for stock investments and so on.

Forex can also start trading even from the sale, you can also make a profit.For example, it is a way to make a profit when “one dollar is 110 yen” and “it is likely to be a strong yen” to “one dollar to 100 yen”.Let’s take an example and explain the following.

For example, if the exchange rate is “1 million yen” and the exchange rate is “1 dollar to 110 yen”, you want to sell “10,000 dollars”.And, since the exchange rate is “1 dollar to 100 yen”, if you confirm the profit of buying back (settlement) of “10,000 dollars”, it will be the following profit.

(110 yen – 100 yen) x 10,000 dollars – 1.1 million yen

1.1 million yen – 1 million yen – 100,000 yen

The exchange rate of “10 yen” fluctuated, so we were able to get a profit of 100,000 yen from buying the same foreign exchange gain as the method of selling.

You can also order from a sell, so you can profit from buybacks from the sale.This is “how to profit from buyback from sell”.

You can also order from the sale.

So no matter what the market is, whether the price goes up or down, you can make a profit from both from buying or selling.

What is FOREX?-3. How to make a profit with swap points

In Forex, in addition to the exchange rate gain due to price fluctuations in “How to make a profit from buying” and “How to make a profit from buyback from buying” described earlier, there is another chance to profit.That’s how to make a profit from swap points.

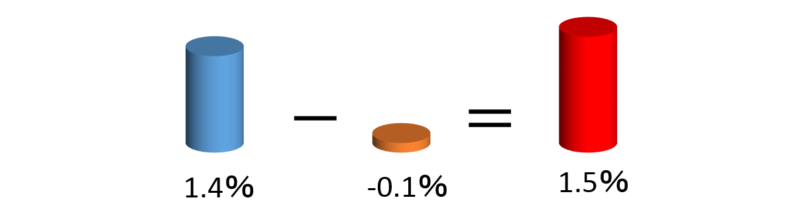

In Forex trading, the exchange of interest rates is carried out at the same time as exchanging currencies from two different countries. Since the interest rates in each country are different, the difference must be adjusted, and the interest rate difference adjustment amount is the swap point.If you buy a high-interest currency and sell a low-interest currency, you can receive swap points by carrying over (rollover) the position to the next business day.

I will explain what it means by giving an example.

For example, if USD/JPY buys 10,000 currencies when it is 1 U.S. dollar to 100 yen (buying U.S. dollar, selling yen), and the interest rate difference is 1.5%, you can receive a swap point of 45 yen per day.

Conversely, if you sell 10,000 currencies (sell US dollars, buy yen), you will be paid a swap point of 77 yen per day.

If you hold USD/JPY for one year with a purchase of 10,000 currencies,

45 yen x 365 days: 16,425 yen

It is a small amount in one day, but it will be about 16,000 yen by carrying over for one year.

Interest rate difference

United States 1.4% – Japan -0.1% – Interest rate difference 1.5%

In short,

If you buy a high-interest currency and sell a low-interest currency, you will receive swap points.

Buy low interest currencies, sell high interest currencies, and pay swap points.

This is “how to make a profit with swap points”.

Swap points happen every day, don’t they?

It sounds easy, but it looks like you can’t do it without a lot of money.

Even a small amount of money is no problem because there is leverage.

More to the point, you don’t have to hold it all day, so you just have to hold it when swap points occur.

What is FOREX?-About the risk of Forex

Forex (Foreign Exchange Margin Trading) is not a financial instrument with a guaranteed principal or profit.

In trading Forex, the higher the leverage, the greater the return can be expected if the market proceeds as expected, but if you proceed in the opposite direction of speculation, there is a risk of a large amount of loss.

Swap points will be changed without notice according to the interest rate policy of each country.

In addition, if the interest rate difference in each country is reversed, it may shift from receiving swap points to paying.

Before you start trading, you need to fully understand the mechanics and risks and make a deal.

Since the notes and risks of trading about Forex are described in the site of each Forex trader, please be sure to look before trading.

What is FOREX?- Summary

In this article, what is Forex of the content that I examined and learned when I started Forex?I have explained “basic knowledge about Forex” with images to those who start Forex from now on, such as what is, how much money is needed to start and how much forex trading mechanism is needed, why profit comes out, leverage, etc.

Please refer to it because it keeps the summary in the list.

- FX is foreign exchange margin trading.

- Forex can trade 24 hours a day.

- Forex can be started with a small amount.

- Forex, by leverage, can be a large transaction with a small amount.

- Forex is profitable from foreign exchange gains.

- In Forex trading, profits are generated from buying or selling.

- FX can receive swap points.

- Know that Forex has both returns and risks.

I would appreciate it if it becomes information that becomes “good to examine” information that is useful even a little.